|

Southern States Forwarding, Inc.Freight Forwarders and Customs House Brokers |

|

Southern States Forwarding, Inc.Freight Forwarders and Customs House Brokers |

|

Substantially Superior Forwarder To us, SSF stands for Southern States Forwarding, but to our customers, it stands for Substantially Superior Forwarder because of the consistent level of outstanding service we provide for each and every shipment we handle. |

|

|

|

5269 Brantford Road / Memphis, Tennessee 38120 USA (901) 763-3044 ~ fax (901) 763-1999 ~ bruce@ssfwd.com |

Greetings,

My name is Bruce Friedman. My involvment in the cotton industry has fell off when I

attended Concord Law School but by popular demand, I am back now. In order 2 get 2 know u better,

I want to give each of you a hug... (hand out Hershey’s chocolate hugs;

use the rest of the bag as rewards for participation).

My company, SSF is the best darn ocean freight forwarder, especially for cotton. We are the best

because of our people and dedication to excellence.

I graduated from this cotton school in 1997 with distinction.

I am honored to be the first alumnus to come back to teach, and the first

forwarder/OTI to be invited back. I’m married; I have 2 wonderful children, Kimberly does research

at St Jude, and Brian just graduated with a masters in architecture and sound design. My wife is an

expert at handling wild animals and she is in charge of the Great Outdoors University in west TN.

I got my BA in Business & I did my masters work in Computer Science at Vanderbilt

University in Nashville. I graduated from Concord Law School in 2006 and passed the California Bar on

my first try also in 2006. I was born & raised here in Memphis. I am

considered an authority on international trade. I am a licensed forwarder, customs house broker, C-TPAT,

ICPA, Import-Export panelist, and practicing Attorney.

What is an International Freight Forwarder?

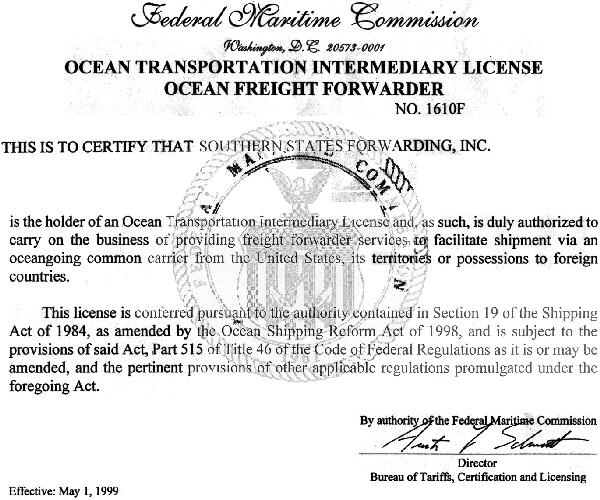

Under the 1998 shipping act, a freight forwarder is now

considered an OTI, Ocean transportation intermediary.

In this country, you can do your forwarding yourself,

or you can go to a Licensed Freight Forwarder. The license is issued by

the Federal Maritime Commission. In order to qualify for the license you

must have at least 2 years experience in forwarding, six references, a

thorough background check, and file a $50,000 bond with the FMC.

Anybody know what a bond is?

As a forwarder, our goal is to help. For example, the handouts we prepared in our office are already hole punched to fit in your binders. Shane McCormick remembered waiting for the hole punch for notes when he took this class a few years ago. Also, we gave each of you business card holders that will fit into your binder. This will allow you to keep up with the business cards you get while in school.

A freight forwarder is a professional involved in facilitation

export shipments. There are hundreds of forms he uses, such as export licenses,

bills of lading, Shipper’s Export Declarations, Dock Receipts, Certificates of Origin,

Phytosanitary applications, Phytosanitary inspections, Phytosanitary certificates,

packing lists, stowage plans, sailing schedules, etc. A forwarder must

know thousands of rules and regulations like UCP 600, Incoterms, shipping

acts, tariffs, licensing requirements, etc.

Very quickly, the bureau of export administration (recently changed to the

Bureau of Industry and Security) keeps a list of denied persons, denied countries, and

regulated commodities for security reasons.

Other agencies we deal with on a regular basis would be Homeland Security,

Department of Census, Department of Commerce, USDA and US Customs.

We are expected to fully understand the transportation

process and give expert advice. For example, anyone know what a General Average

is? Ocean transportation is based on ancient Phonecian law. Should the vessel

encounter additional charges, everyone with cargo on the vessel must participate

in paying, and your portion of the additional charge is called a General Average.

This is why you need insurance.

A forwarder must verify he does not accept illegal

rebates or kickbacks, nor can he have a beneficial interest in any shipment

he is handling.

What we do is complicated. You do not have to use a forwarder. Traditionally, no cotton company exported without the help of a licensed forwarder.

Why do you need a forwarder?

Few companies can afford to pay someone with my knowledge and expertise in international trade. Penalties

for not complying with the rules are mind boggling, and the regulators who enforce them do not

consider ignorance of the law to be a valid defense.

There exist a set of underlying rules and regulations such as the CFR 19 (Code of Federal Regulations),

UCC section 2 (Uniform Commercial Code), Transportation Law, USDA EXERPT regulations,

EAR (Export Administration Regulations) the Lacey Act, BIS (Bureau of Industry and Security) ...

(and I'm just getting warmed up) that I am fully familiar with, and can help you avoid the potential pitfalls.

A forwarder should be able to book shipments and hustle the paperwork faster than the shipper can do

himself. This function alone should make your forwarder extremely valuable.

On the other hand,

should you use a forwarder? It will save you some money, but is it worth it?

Next, let's look at the differneces between a traditional forwarder and an NVO/NVOCC. Anyone know what an NVO is?

Traditional OTI/Forwarder

NVO/NVOCC

In order for a forwarder to act on behalf of a shipper, the forwarder must have a power of attorney on file. Anyone know what a POA is?

Because the forwarder has a power of attorney,

he can work for and negotiate business as if he works for you. Your forwarder

can sign a contract that obligates you. 100 years ago, a forwarder would

receive funds from a shipper, and travel along with the shipment, paying

each warehouse, inland carrier, stevedore, ocean carrier, insurer, inspector,

tax and duty as they went. Because of this tradition, many shippers pay

all these expenses to the forwarder, and expect the forwarder to pay each.

If the forwarder does not pay, you potentially could have to pay twice. Make sure you

are dealing with a properly licensed and bonded forwarder or you could get burned.

When I took this class, the question on

the test was: What two functions must a forwarder perform on every transaction?

A. Engage, secure, book, reserve or contract directly

with carrier or his agent for space aboard a vessel or confirm the availability

of space...

B. Prepare and process ocean bill of lading, dock receipt,

or other similar document with respect to shipment.

Anyone want to translate?

US Merchant

Using actual names & illustrations, student

in back RH corner, will be textile buyer in Hong Kong __HKbyr__. Student

in front LH corner will be cotton merchant in USA __seller__. Bill asked

a question on one of his early tests, something about the various ways

cotton was sold. The correct answer was by Green Card, by Type, by actual

samples etc. In addition to these answers, I put down begging, pleading,

entertaining, visiting, and negotiating. Bottom line, these gentlemen will

enter into a sales contract. This contract will mention what rules they

will fall under. Does anybody know what contract rules are? Does anybody

understand the concept of a boilerplate? (candy for answers). Memphis Territory,

Liverpool, ACSA rules are beyond what I am here to talk about today, but

they are extremely important in the sales contract.

Taken a step further, once the contract is agreed upon,

how safe is this transaction? Any ideas of what can go wrong?

Can the buyer pay for what he does not get?

Can the seller ship and not get paid?

How do we protect ourselves?

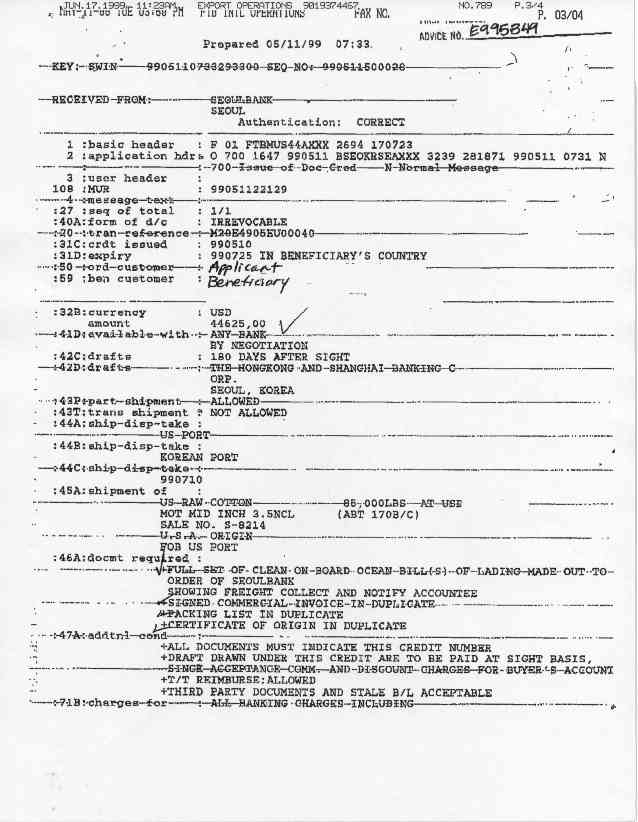

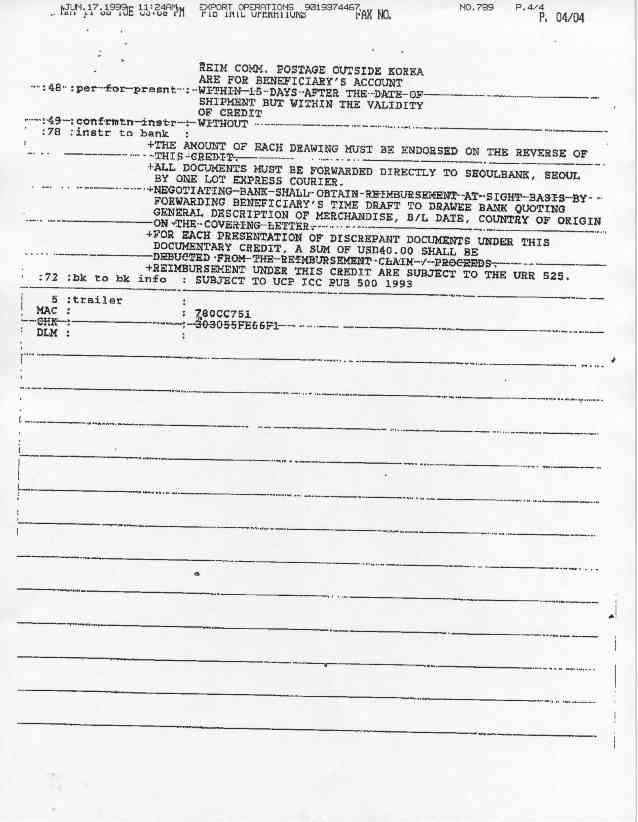

Let’s bring some more players into the picture. As a guarantee of payment, Mr. Textile mill buyer __HKbyr__, goes to his bank and asks to open a letter of credit. His banker in HK will be __Hkbank__. This L/C is a guarantee to pay when all of its requirements are met. The L/C will fall under the UCP500 boilerplate banking rules and regulations. We will not have time to go into details on UCP600, but if you have questions, I will do my best to explain. The UCP600 is a boilerplate the same as the Liverpool rules are to a sales contract, or the text on the back of the bill of lading are to a shipment.

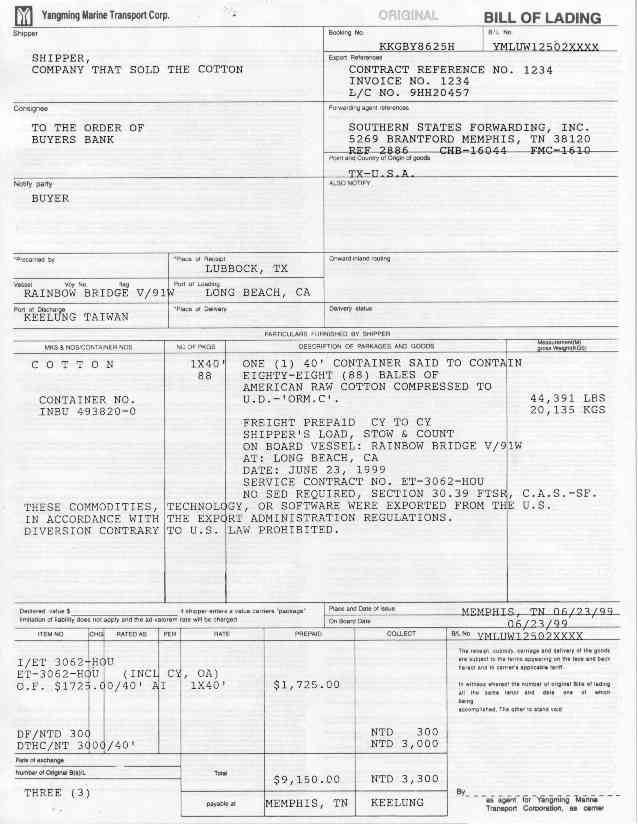

We also need a SteamShip company to transport the goods.

Towards the back center __ssco__ is our SSCO person. Now __ssco__ our SSCO

person is going to issue a “Negotiable” bill of lading.

Anybody know what a negotiable bill of lading is?

It carries title to the goods.

The letter of credit Mr. banker in Hong Kong __HKbank__ issued will have specific terms as to how the bill of lading is to read.

Now back to Mr. shipper in the USA __seller__, he will

give his forwarder instructions and a copy of the L/C, and say get this

shipped, send all necessary documents to the bank, & get me my money.

What can go wrong?

Bogus international bank, or a good international bank

goes bust.

Therefore, get an affiliated bank in the USA __usabank__ will be a US banker, who for a fee will guarantee payment from the foreign bank. The truth of the matter, you are much better off dealing with a domestic bank. If you have problems, a bank in your own country operates under the laws of your country, and will be reachable.

Let’s put the whole picture together. ___seller__ the US cotton merchant sells cotton to ___HKbyr_______ in Hong Kong. ___HKbyr____, opens a L/C with __Hkbank__, the bank in HK. __HKbank_ sends the L/C to the affiliate __USbank__ with a US bank, who then forwards the L/C to the seller __seller__.

Next __seller__, the US merchant contracts with HK lines __ssco__, and trades the cargo for a b/l. This bill of lading along with all other necessary documents will be put together by his forwarder, and sent to the US bank __Usbank__. The US bank will pay __seller__ according to the terms of the L/C & their agreement, and will send everything on to __Hkbank__ with the bank in Hong Kong.

__Hkbank__, with the bank in HK, depending on his relationship and terms with __HKByr__, the buyer in HK, will probably give the documents to __Hkbyr__ in exchange for a promissory note.

Final step. The first person to present an original negotiable bill of lading at destination will have title to the goods. __Hkbyr__ takes the documents to __SSCO__, with the carrier (steamship company), and gets his cotton.

That was easy!

Anybody here see the loophole?

Three pieces of advice from the bank.

1. Do not send your customer one of the originals and

bank the other two. Your customer could get possession of the shipment

with the one you sent, and not have to pay.

2. Make sure the bill of lading is endorsed. If it was

consigned to order of shipper, the shipper must sign the back of the B/L

in order for it to be negotiated.

3. Do not use the buyer’s forwarder. Your forwarder knows

you and should help you get paid as quickly as possible. A buyer’s forwarder

might look after the buyer first, and you could have delays in getting

paid, or in a worst case, not be able to collect through banking channels.

Easy example of what an OTI, Ocean Transportation Intermediary (formerly known as a freight forwarder) does on a cotton export shipment.

Assume a shipment of 88 bales of cotton from Memphis, TN to Keelung Taiwan. First you will need to decide how to ship, and which ocean carrier to ship this with. To move from Memphis to the west coast, you have a choice of IPI (Inland point intermodal), or OCP (Overland common point). On IPI, the steamship company, carrier has control/responsibility to move the container from the inland point, Memphis, TN to the pier in Long Beach, CA. The charge for this will appear on the bill of lading. With OCP, the carrier will provide containers in Memphis, but the responsibility of moving the container from Memphis to the pier in Long Beach is the shipper’s. Further, charges for and proof of inland transportation can not appear on the ocean bill of lading.

The shipper decides to ship this IPI with OOCL, and places a booking. At this point the shipper will send a full set of instructions to their Forwarder (OTI).

The forwarder must confirm the booking with

OOCL, and prepare a bill of lading Master. Further, the forwarder must

prepare the SED electronically.

The forwarder should then push the carrier to issue a bill of lading as

quickly as possible.

Any questions?

With my company, our prime directive is to facilitate

turning cotton into cash as quickly as possible.

Let’s get difficult.

GRIFCOT just sold 200 MT of MOTE cotton to

Alexandria, Egypt.

Bill is busy teaching school, so he calls his

forwarder and asks for costings to move this shipment. Since the forwarder

has power of attorney, he is able to negotiate rates and act on behalf

of the shipper.

The tariff rate from USGC (US Gulf Coast) to Alexandria might be $3,000 per FEU (40’ equivalent unit), or 40’ standard container. As a forwarder I should know YangMing is sending containers back to Alexandria empty. Therefore I should be able to negotiate a contract for $135 per MT if we ship 25 TEU’s within 6 months.

The costings I give to Bill would be something

like:

Inland Lubbock to New Orleans $1400

Memphis to New Orleans $ 750

Gastonia to New Orlenas $ 1800

Selma, AL to New Orleans $ 450

Winnsboro to New Orleans $ 350

Receiving, and stuffing at Kearney Warehouse $2.00 per bale.

Fumigation:

Phosphene in container $3.00 per bale, takes

72 hours, and requires $340 in USDA overtime.

Methyl Bromide, 24 hours

Staging in warehouse $2.00 per bale

fumigation $2.00 per bale

If the temperature drops below 40 degrees Fahrenheit

at any point during fumigation, you must start over, and all the fumigation

costs will double.

Dray to port $250 per container

OF $2,700. per container

THC $500 per container

CAF $2.00 per MT

BAF $5.00 per MT

Container repositioning surcharge $100 per

container

Arbitrary for Alexandria $400 per container

DDC $360 per container

Wharfage $1.60 per standard ton

Forwarding Fees $.35 per bale

Phytosanitary Certificate $105

Certificate of Origin $15

Insurance 0.5% of value

If you have a forwarder who deals in commodities, he might understand points. I could tell Bill 1,586 points, but I always give all the backup information.

Greetings Bill,

Thank you for your inquiry. Your costs will be:

Inland Lubbock to NOLA $1400

Memphis to NOLA $ 750

Gastonia to NOLA $1,800

Selma, AL to NOLA $ 450

Winnsboro to NOLA $ 350

Receiving, and stuffing at Port Warehouse $2.00 per bale.

Fumigation:

Phosphene in container $4.00 per bale, takes 72 hours, and requires $340 in USDA overtime.

Methyl Bromide, 24 hours

Staging in warehouse $2.00 per bale

fumigation $4.00 per bale

If the temperature drops below 40 degrees Fahrenheit at any point during fumigation, you must start over, and all the fumigation costs will double.

Dray $250 per container

OF $2,700. per container

THC $500 per container

CAF $2.00 per MT

BAF $5.00 per MT

Container repositioning surcharge $100 per container

Arbitrary for Alexandria $400 per container

DDC $360 per container

Wharfage $1.60 per standard ton

Forwarding Fees $.35 per bale

Phytosanitary Certificate $105

Certificate of Origin $15

Insurance 0.5% of value

We appreciate the opportunity to quote. Please advise when you want us to start on this shipment.

B/rgds,

SSF/Bruce Friedman

Costing spreadsheet

1. The first thing we do is read the L/C. If the L/C is workable, and no amendments are necessary, we proceed.

2. The second thing we do is call to check on when the cotton can be ready for pickup, and book with the SSCO. We have to make sure they have equipment available, and space on a vessel sailing before the L/C expires.

3. Line up the trucking.

4. Advise the port warehouse, Kearney.

5. Advise USDA and send instructions

6. Contract with the fumigator, and send instructions.

7. Call and fax Wakefield for inspection

8. Bind insurance

9. Get loading reports, container numbers, & seal numbers.

10. Prepare, Letter of Instructions, B/L master, & SED for SSCO

11. Transmit SED information to Census and US Customs.

12. Certificate of Origin, notarized and stamped by local chamber of commerce.

13. Call everyone to get documents.

14. Deliver to the bank: Letter of transmittal with payment instructions, Commercial invoice, L/C original, B/L originals, CO, Phytosanitary Certificate, SGS inspection, Packing list, stowage plans, insurance certificate, and anything else the L/C requires.

15. Call bank daily for updates on payment.

16. Invoice GRIFCOT.